- Tax Dispute

- Criminal tax law

- Voluntary Self-Disclosure

- Criminal Tax Proceedings

- Penalty for Tax Fraud

- Limitation Period for Tax Fraud

- Commencement of Criminal Tax Proceedings

- Tax Investigations / Search of Premises

- Freezing Injunction / Seizure of Assets

- Pre-trial Detention for Tax Fraud

- Corruption / Bribery

- Witness in Criminal Tax Proceedings

- Undeclared Income / Illegal Employment

- Criminal Risks for Directors of Limited Liability Companies

- Tax Compliance Management System (TCMS)

- Focus on Tax Compliance and Tax-CMS in Germany

- Missing trader intra-community (MTIC) fraud / VAT fraud

- Commercial Criminal Law

- Internat. Tax Law

- Tax Planning

- Corporate law

- Property Succession

Company Tax Audit

Legal and Tax Advice: Verification of revenue using data processing (digital company tax audit) and proper cash accounting

German companies are increasingly faced with growing risks posed by company tax audits. Being notified of a company tax audit therefore causes anxiety in many companies. Nobody appreciates the tax auditor snooping in their documents. There is also the prospect of hefty payments for back taxes based on arbitrary assessments of the company tax audit or even the possibility of criminal tax proceedings. In the end, many issues are a matter of discretion. No company owner or director can assume with certainty, that he is aware of all applicable laws and regulations - including amendments - and has correctly applied all of them.

Our experience as tax law specialists and tax advisers assists you in a company tax audit, including a field audit.

The handling of cash is the focus of attention in audits of smaller companies operating in cash-based industries (bakeries, butchers, cafés, pubs, restaurants, confectionery retailers, tanning studios, retail in general, taxi operators). Tax inspectors frequently accuse companies of having invented their cash accounting out of thin air and justify the accusation with new statistical audit methods such as the “Chi-Square-Test” or “Benford’s Law”. Small errors may result in massive ramifications due to computerised arbitrary assessments made by calculation software and can ultimately threaten economic survival. Additionally, criminal tax proceedings are frequently commenced against the legal representatives of the company. Unfortunately, even tax advisers are sometimes made liable as indemnitors.

Anticipatory planning is paramount for the outcome of a company tax audit - to avoid arbitrary assessments.

The issue of arbitrary assessments is not only a financial risk, but also bears the risk of being subjected to criminal proceedings for tax fraud. In the worst case, if bogus invoices are discovered, the crime of document forgery may be alleged. These matters are always referred to the public prosecutor’s office. This is the time, when an adviser/lawyer/specialist for tax law and criminal tax law should be instructed to coordinate the fiscal and criminal proceedings. The individual methods employed in a tax audit are complex and only an initial overview can be provided here. One of the specialist practice areas of LHP Lawyers and Tax Advisers is the rebuttal of arbitrary assessments in company tax audits.

Facts about company tax audits and audit methods

Cash accounting

Company tax audors are particularly interested in cash accounting. An audit of cash accounting aims at establishing or refuting the correctness of the accounts. An audit of the cash accounts is only considered proper, if it enables a continuous reconciliation of the cash at hand with the cash accounted for (so-called cash check).

If the cash accounting complies with the formal requirements set out in the law, then the accounts are deemed to be correct (§ 158 AO). If the situation is vice-versa, this does not necessarily result in detrimental effects for you: If the cash accounting does not comply with the formal requirements, this alone is no compelling reason to assume the factual non-compliance of the accounts. If the Tax Authority makes an arbitrary assessment, this must be queried and refuted if necessary. Our extensive practical experience in providing support during company tax audits assists in these cases.

How does the company tax auditor conduct an audit of income?

As a general rule, all transparent audit methods are permitted, there are no statutory requirements in this respect. Most audit methods aim at examining the accounting results (comparison of company assets) and the transactions in the profit and loss statement in respect of their consistency and conclusiveness.

The risk an arbitrary assessment is particularly high, if factual deficiencies in the accounting are evidenced (e.g. the omission of income, incomplete records of incoming and outgoing goods, missing or bogus receipts). On the other hand,formal deficiencies alone do not justify arbitrary assessments (e.g. accounting positions entered at a wrong time or delayed drafting of balance sheets).

External benchmarking

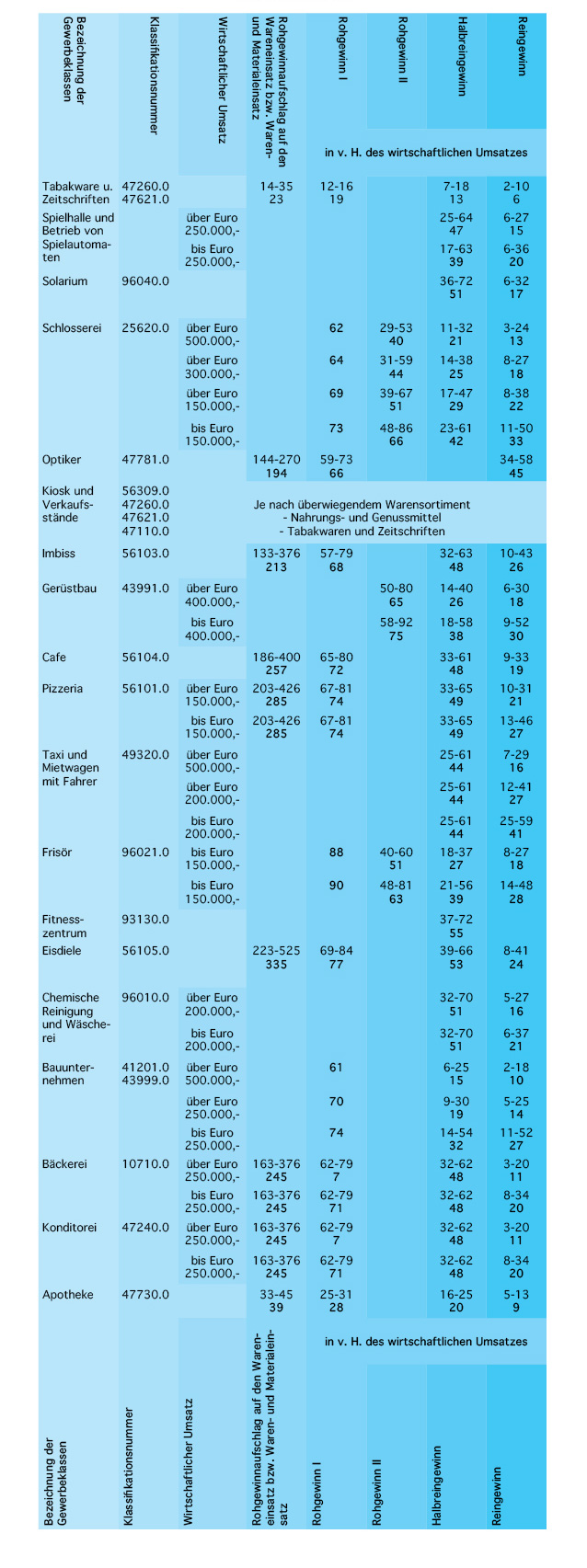

The purpose of external benchmarking is to verify the results of the audited company against the results of comparable companies. The tax auditor applies so-called indicative rates, which are indicators derived by the Tax Authority in company tax audits over many years.

Some examples of indicative rates from the current publications by the tax administration:  Source: www.bundesfinanzministerium.de

Source: www.bundesfinanzministerium.de

Internal benchmarking

Using post-calculation of the revenue, the tax auditor can assess the revenues that should have been generated based on the accounted use of purchased goods (retail) or the raw materials and personnel expenditure (manufacturing / production).

Calculation of capital gains and cash flow calculation

These validation methods are used as ancillary methods in arbitrary assessments, if the income and asset situation of a taxpayer is not transparent and undisclosed income is suspected. These methods are based on the principle, that a business person cannot spend more money than is available to him during the same period. This calculation method may be adopted, if the accounts are unusable due to established deficiencies.

Validations and arbitrary assessment of revenues

Post-calculation (margin calculation) is the most frequently used method in tax audits, which can establish the inaccuracy of the declared taxable income, even if the accounting was formally correct. In the case of trading companies, the margin calculation looks at the cost of goods sold. For manufacturing companies, the focus is on the costs of raw materials, personnel expenditure and use of production resources. The more product categories a company has, the more differentiated the calculation ought to be, which means that a separate margin rate must be calculated for each product category.

This is one of the major weaknesses of this method. This method is very demanding for larger companies and an increasing company size makes it increasingly prone to challenges. A further weakness can be seen in using the cost of goods sold, which does not yield reasonable results if significant quantities of input goods were purchased off-market.

Time-series comparison

The so-called time-series comparison was developed due to the before-mentioned weakness of the margin calculation method failing to clarify off-market purchases. The time-series comparison assesses the gross profit margin, which is derived from the relationship between accounted income and expenditure.

If the time-series displays unusual variances in the gross profit margin, it follows that the respective circumstances must be explained in detail. The time-series comparison method is currently only used in cases, where it was not possible to base the tax assessment on the accounts for other reasons as set out in §158 AO. The Cologne Fiscal Court has decided in a current judgement, that proper accounts cannot be invalidated exclusively on the basis of a time-series comparison.

Chi-Square-Test (Chi²-Test)

This method is based on probability theory and the realisation, that the numbers 0 to 9 occur in the same regular frequency at certain positions, in particular before or after a comma. If this is not the case, it is usually due to a special preference for certain figures and indicates the presence of manipulated numbers. Jurisprudence has however emphasized, that such an increased frequency of certain numbers by itself is not sufficient evidence to refute the correctness of formally proper accounts. It follows, that further audit methods must be used in such a case.

Benford’s Law

This is also an audit method utilizing the rules of probability. Number theory posits, that the numbers contained in genuine data follow certain patterns, which are not present to the same degree in falsified data. This method presupposes the availability of numbers in a sufficient quantity. It cannot be used, if the company tax auditor only operates with a smaller set of numbers.

These deliberations show, that knowledge of the current jurisprudence and regulatory directives in respect of company tax audits and tax investigations is essential for an effective defence and advice. Due to the high workload entailed by large-scale company tax audits, it is highly recommended to have a number of competent tax lawyers and accountants at hand. A law firm specialising in company tax audits is best suited to assist in these matters.

Conclusion: A law firm specialising in tax law should be consulted if a company tax audit is foreseen. The scope of the required advice and support will be determined in an initial consultation. This consultation should not be procrastinated, in order to minimize the tax burden as far as possible. A consultation should also take place as soon as possible in respect of criminal risks.

As tax-lawyers, tax advisers and tax law specialists, we offer comprehensive advice before, during and after company tax audits:

- at any time, even when a company tax audit has not been expected,

- if a company tax audit has been pre-announced (it might be possible to submit a voluntary self-disclosure if the Tax Authority has merely hinted at a company tax audit over the telephone, but no official notice of company tax audit has been received yet).

- An analysis of the weak points in respect of taxation and criminal tax law as well as corresponding options should be conducted prior to the company tax audit.

- We will develop a suitable strategy.

- We will ensure you have legal certainty at the end of the company tax audit, e.g. by way of obtaining a so-called confirmation letter or by entering into a factual agreement.

- In the worst case, we offer to conduct litigation in respect of objection proceedings and at the Fiscal Courts.

Cologne

An der Pauluskirche 3-5, 50677 Cologne,

T: +49 221 39 09 770

Zurich

Tödistrasse 53, CH-8027 Zurich,

T: +41 44 212 3535